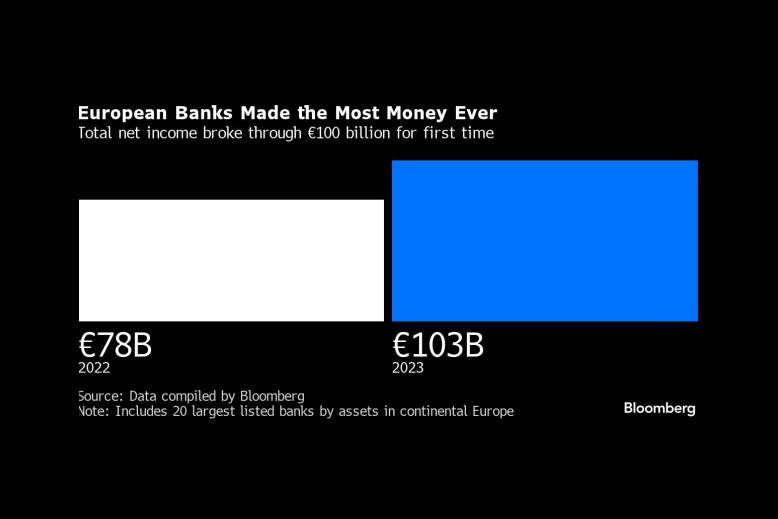

For the first time in history, Europe’s banking behemoths have collectively breached the €100 billion profit ceiling, fueled by a significant uptick in interest rates that propelled most to record earnings.

The aggregate net income of the continent’s top 20 banks, following the publication of their financial outcomes, soared to €103 billion from €78 billion in the preceding year. An impressive three-quarters of these institutions reported the highest profits in their storied histories, according to data amassed by Bloomberg.

This surge in profitability has enabled the financial powerhouses to amplify the returns to their investors and bolster their stock valuations.

Despite the challenge in replicating this monumental profit leap due to the anticipated ebb in the interest rate surge, a wave of optimism persists among many banks. They anticipate that an increase in fee-based revenues will sustain their growth trajectory.

It’s noteworthy that Bloomberg’s analysis excludes UBS Group AG, which saw its profits skyrocket to $29 billion last year, following its acquisition of Credit Suisse, further highlighting the lucrative phase the sector is experiencing.