Want to grab that coffee or package and go? You’re not alone. Today more than ever, people are living an increasingly digital – and mobile – life and they expect their ability to pay for their needs and wants to match that same “always on” mindset, according to social media conversations identified in the 2019 edition of the Mastercard Digital Payments Study.

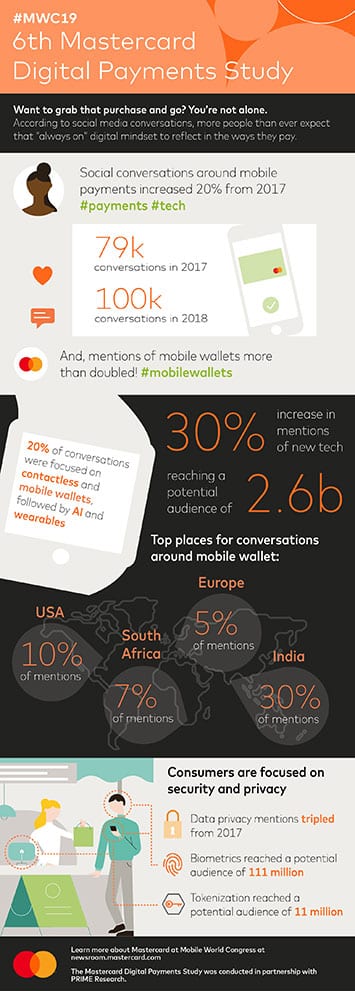

Mobile payments represented more the 27 per cent of the total social media conversation around payments, with total mentions increasing 20 per cent over the prior year. Mentions of mobile wallets specifically more than doubled since 2019.

Mobile payments represented more the 27 per cent of the total social media conversation around payments, with total mentions increasing 20 per cent over the prior year. Mentions of mobile wallets specifically more than doubled since 2019.

Now in its sixth year, the Mastercard study, developed in partnership with PRIME Research, analyzed more than 3.3 million conversations from the past year across several social media channels, including Twitter, Facebook, Instagram and Weibo.

Interest in New Technologies

People are looking for newer technologies to have an impact on their lives. In the past year alone, such mentions on social media increased by 30 per cent since the last study. Today, nearly 20 per cent of all mobile commerce payments conversations are focused on contactless payments and mobile wallets. Beyond these primary focus areas, consumers are interested in how artificial intelligence, QR payments and wearable payments will impact their lives.

Overall, people are increasingly positive toward these newer technologies. Virtually all (95 per cent) mobile wallet conversations were favourable, with 30 per cent of posts praising the speed, efficiency and simplicity of the current products.

The adoption of mobile payments is seen in markets across Asia and Africa. India was the most dominant market – 30 per cent – in discussing the use and potential of mobile wallets, particularly around public transit and the use of QR-based payments, led by specific references to MasterpassQR and PaytmQR in India. The U.S. was a distant second in consumer’s discussions on mobile wallets (10 per cent).

Primed for Action with Peace of Mind

Among the conversations analyzed, consumers clearly continued to be focused on the security of their money and their data as a foundational requirement. In their posts, people recognize the value of new technologies on delivering this peace of mind across mobile payments.

Looking at the newer technologies:

- Biometrics reached a potential 111 million, driven primarily by an interest in voice payments and fingerprint scanners

- Tokenization – and its critical role in supporting and protecting payments of all type – was featured in conversations reaching a potential audience of 11 million viewers

While breaking news around data breaches drove one-fifth of data-related conversations, another 13 per cent of these conversations noted the potential of digital security technologies, including blockchain, tokenization and biometrics.