E-commerce a Covid Lifeline for Retailers with Additional $900 Billion Spent Online Globally

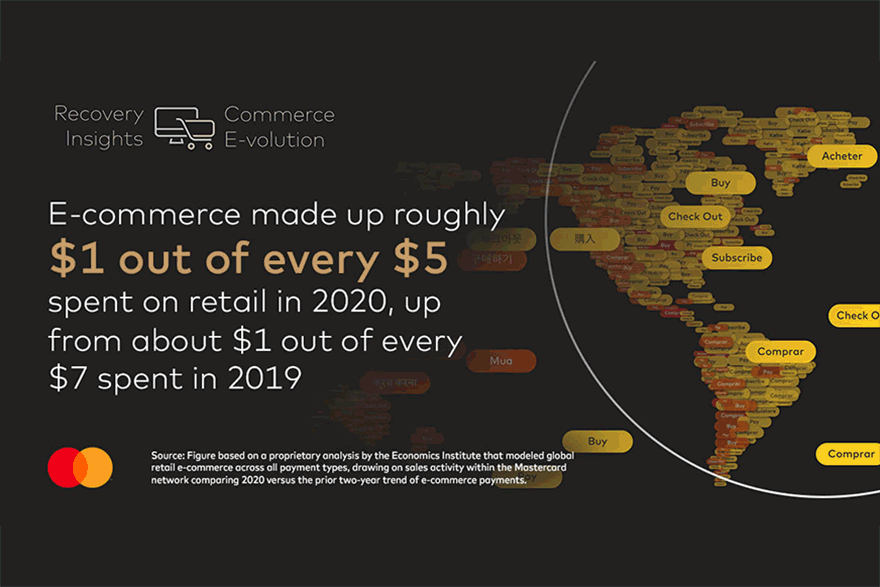

As Covid-19 kept consumers around the world at home, nearly everything from groceries to gardening supplies was purchased online. According to Mastercard’s latest Recovery Insights report, this amounted to an additional $900 billion being spent in retail online around the world in 2020. Put another way: in 2020, e-commerce made up roughly $1 out of every $5 spent on retail, up from about $1 out of every $7 spent in 2019.1

For retailers, restaurants and other businesses large and small, being able to sell online provided a much-needed lifeline as in-person consumer spending was disrupted.

Roughly 20-30% of the Covid-related shift to digital globally is expected to be permanent, according to Mastercard’s Recovery Insights: Commerce E-volution. The report draws on anonymized and aggregated sales activity in the Mastercard network and proprietary analysis by the Mastercard Economics Institute. The analysis dives into what this means by country and by sector, for goods and services, and within countries and across borders.

“While consumers were stuck at home, their dollars traveled far and wide thanks to e-commerce,” says Bricklin Dwyer, Mastercard chief economist and head of the Mastercard Economics Institute. “This has significant implications, with the countries and companies that have prioritized digital continuing to reap the benefits. Our analysis shows that even the smallest businesses see gains when they shift to digital.”

While the digital transformation has been neither universal nor consistent – due to geographical, economic, and household differences – the report uncovers several key overarching trends:

- Early digital adopters go into overdrive: Economies that were more digital before the crisis—such as the UK and US —saw larger gains in the domestic shift to digital that look more permanent than the countries that had a smaller share of e-commerce before the crisis, such as Argentina and Mexico. Asia Pacific, North America, and Europe were the strongest regions in driving e-commerce adoption.

- Grocery and discount store digital gains look sticky: Essential retail sectors, which had the smallest digital share before the crisis, saw some of the biggest gains as consumers adapted. With new consumer habits forming and given the low pre-Covid user base, we anticipate 70-80% of the grocery e-commerce surge to stick around for good.

- International e-commerce rose 25-30% during the pandemic: International e-commerce got a boost both in sales volume and the number of different countries where shoppers placed orders. With infinitely more choices at their fingertips, consumer spending on international e-commerce grew around 25-30% year over year from March 2020 through February 2021.

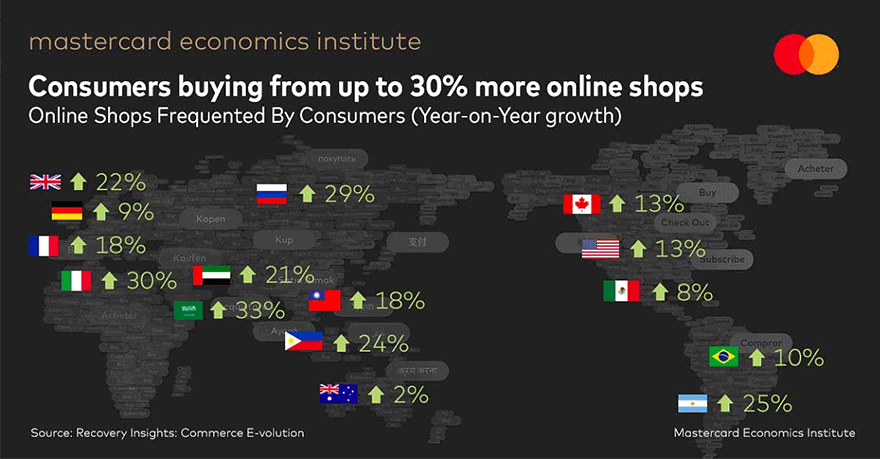

- Consumers increase their e-commerce footprints, buying from up to 30% more online retailers: Reflecting expanded consumer choice, our analysis shows that consumers worldwide are making purchases at a greater number of websites and online marketplaces than before. Residents in countries like Italy and Saudi Arabia are buying from 33% more online stores, on average, followed closely by Russia and the UK.

- Shift to electronic payments accelerated in the US: Even in store, Covid-19 accelerated the transition to digital—with more consumers moving from plunking down cash to touch-free payments. According to our analysis of payment forms at brick-and-mortar retail stores and restaurants, we saw non-cash payments jump by an additional 2.5 percentage points beyond the ongoing trend. This led to an acceleration of the shift from cash to electronic payments by a full year.

Recovery Insights: Commerce E-volution can be viewed here.

Mastercard launched Recovery Insights last year to help businesses and governments better manage the health, safety and economic risks presented by Covid-19. The initiative draws on Mastercard’s analytics and experimentation platforms, its longstanding consulting practice and unique data-driven insights to deliver relevant and timely tools, innovation and research.