A potential invasion of Ukraine by neighbouring Russia would be felt across a number of markets, from wheat and energy prices and the region’s sovereign dollar bonds to safe-haven assets and stock markets.

Below are five charts showing where a potential escalation of tensions could be felt across global markets:

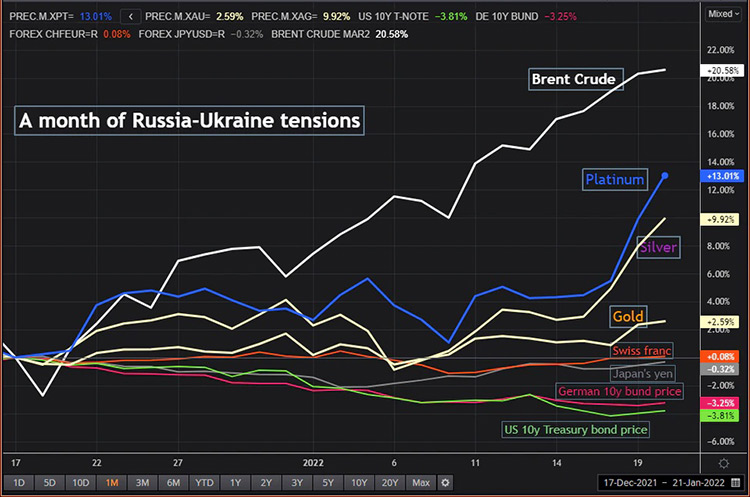

1/SAFE HAVENS

Inflation at multi-decade highs and impending interest rate rises have made for a bad month for bond markets, with U.S. 10-year rates still hovering close to the key 2% level and German 10-year yields rising above 0% for the first time since 2019.

But an outright Russia-Ukraine conflict could change that.

A major risk event usually sees investors rushing back to bonds, generally seen as the safest assets, and this time may not be different, even if a Russian invasion of Ukraine risks further fanning oil prices — and therefore inflation.

In forex markets, the euro/Swiss franc exchange rate is seen as the biggest indicator of geopolitical risk in the euro zone as the Swiss currency has long been viewed by investors a safe haven. It hit its strongest levels since May 2015 on Monday though some of that was due to a widespread selloff on Wall Street.

Gold, also seen as a shelter in times of conflict or economic strife, is clinging to two-month peaks.

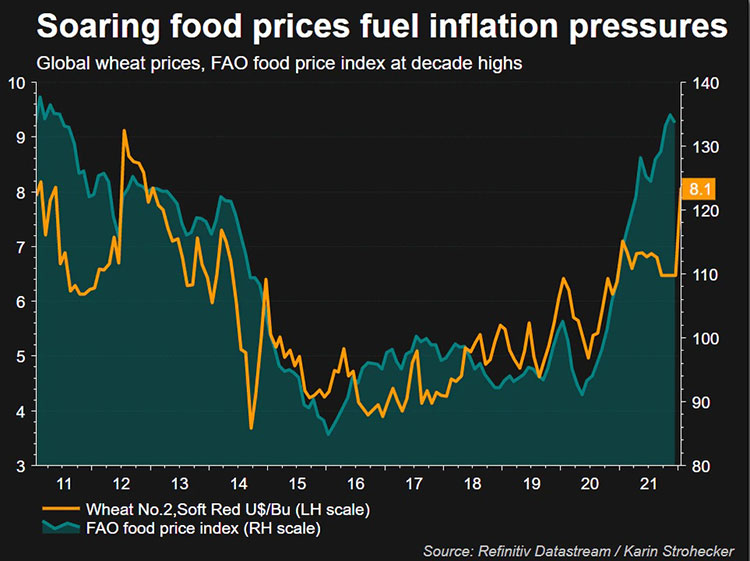

2/ GRAINS AND WHEAT

Any interruption to the flow of grain out of the Black Sea region is likely to have a major impact on prices and add further fuel to food inflation at a time when affordability is a major concern across the globe following the economic damage caused by the COVID-19 pandemic.

Four major exporters – Ukraine, Russia, Kazakhstan and Romania – ship grain from ports in the Black Sea which could face disruptions from any military action or sanctions.

Ukraine is projected to be the world’s third largest exporter of corn in the 2021/22 season and fourth largest exporter of wheat, according to International Grains Council data. Russia is the world’s top wheat exporter.

“Geopolitical risks have risen in recent months in the Black Sea region, which could influence wheat prices ahead,” said Dominic Schnider, strategist at UBS.

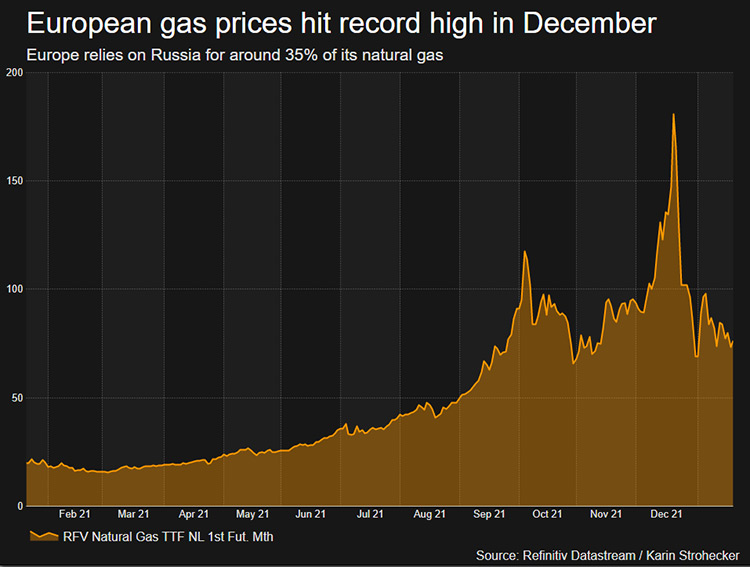

3/ NATURAL GAS AND OIL

Energy markets are likely to be hit if tensions turn into conflict. Europe relies on Russia for around 35% of its natural gas, mostly coming through pipelines which cross Belarus and Poland to Germany, Nord Stream 1 which goes directly to Germany, and others through Ukraine.

In 2020 volumes of gas from Russia to Europe fell after lockdowns suppressed demand and did not recover fully last year when consumption surged, helping to send prices to record highs.

As part of possible sanctions should Russia invade Ukraine, Germany has said it could halt the new Nord Stream 2 gas pipeline from Russia. The pipeline is projected to increase gas imports to Europe but also underlines its energy dependence on Moscow.

SEB commodities analyst Bjarne Schieldrop said markets would expect natural gas exports from Russia to Western Europe to be significantly reduced through both Ukraine and Belarus in the event of sanctions and for gas prices to revisit Q4 levels.

Oil markets could also be affected through curbs or disruption. Ukraine moves Russian oil to Slovakia, Hungary and the Czech Republic. Ukraine’s transit of Russian crude for export to the bloc was 11.9 million metric tonnes in 2021, down from 12.3 million metric tonnes in 2020, S&P Global Platts said in a note.

JPMorgan said the tensions risked a “material spike” in oil prices and noted that a rise to $150 a barrel would reduce global GDP growth to just 0.9% annualised in the first half of the year, while more than doubling inflation to 7.2%.

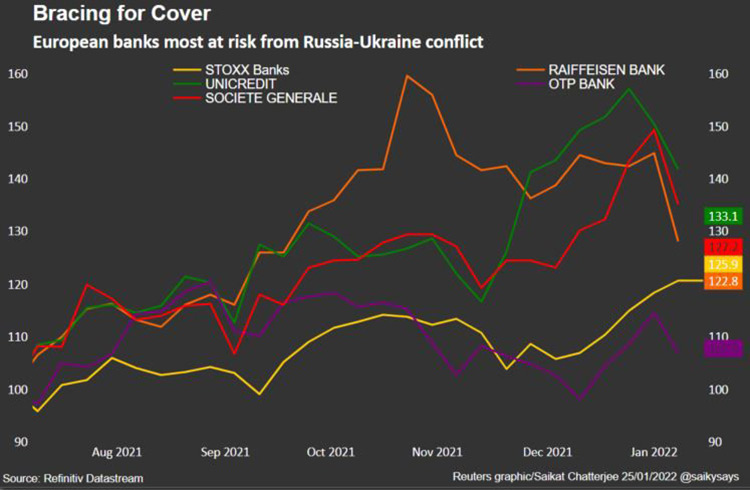

4/COMPANY EXPOSURE

Listed western firms could also feel the consequences from a Russian invasion, though for energy firms any blow to revenues or profits might be somewhat offset by a potential oil price jump.

Britain’s BP owns a 19.75% stake in Rosneft, which makes up a third of its production, and also has a number of joint ventures with Russia’s largest oil producer.

Shell (RDSa.L) meanwhile holds a 27.5% stake in Russia’s first LNG plant, Sakhalin 2, accounting for a third of the country’s total LNG exports, and has a number of joint ventures with state energy giant Gazprom .

U.S. energy firm Exxon (XOM.N) operates through a subsidiary the Sakhalin-1 oil and gas project, in which India’s state-run explorer Oil and Natural Gas Corp (ONGC.NS) also holds a stake. Norway’s Equinor (EQNR.OL) is also active in the country.

In the financial sector, the risk is concentrated in Europe, according to calculations by JPMorgan.

Austria’s Raiffeisen Bank International (RBIV.VI) derived 39% of its estimated net profit last year from its Russian subsidiary, Hungary’s OTP and UniCredit (CRDI.MI) around 7% from theirs, while Societe Generale (SOGN.PA) was seen as generating 6% of group net profits through its Rosbank retail operations. Dutch financial company ING (INGA.AS) also has a footprint in Russia though that accounts for less than 1% of net profit, JPMorgan numbers showed.

Looking at loan exposure to Russia, French and Austrian banks have the largest among Western lenders at $24.2 billion and $17.2 billion, respectively. They are followed by U.S. lenders at $16 billion, Japanese at $9.6 billion and German banks at $8.8 billion, data from the Bank for International Settlements (BIS) shows.

Other sectors also have exposure. Germany’s Metro AG’s (B4B.DE) 93 Russian stores generate just under 10% of its sales and 17% of its core profit while Danish brewer Carlsberg (CARLb.CO) owns Baltika, Russia’s largest brewer with market share of almost 40%.

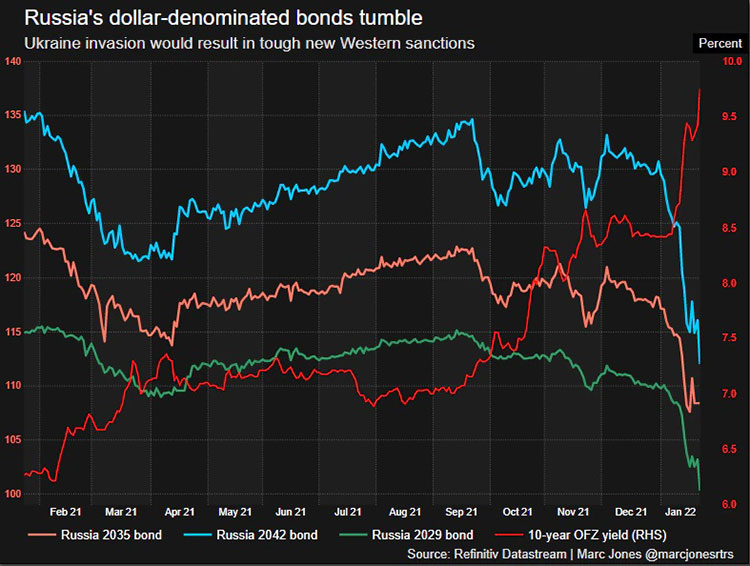

5/ REGIONAL DOLLAR BONDS AND CURRENCIES

Russian and Ukrainian assets will be at the forefront of any markets fallout from potential military action.

Both countries’ dollar bonds have underperformed their peers in recent months as investors trimmed exposure amid escalating tensions between Washington and its allies and Moscow.

Ukraine’s fixed income markets are chiefly the remit of emerging market investors, while Russia’s overall standing on capital markets has shrunk in recent years amid sanctions and geopolitical tensions, somewhat cushioning any threat of contagion through those channels.

However, Russia’s rouble and Ukraine’s hryvnia have also suffered, making them the worst performing emerging markets currencies so far this year.

The situation on the Ukraine-Russian border presents “substantial uncertainties” for foreign currency markets, said Chris Turner, global head of markets at ING.

“The events of late 2014 remind us of the liquidity gaps and U.S. dollar hoarding that led to a substantial drop in the rouble at that time,” said Turner.

Source: reuters.com, Main photo: Press Service of the 92nd Separate Mechanized Brigade/Handout via REUTERS