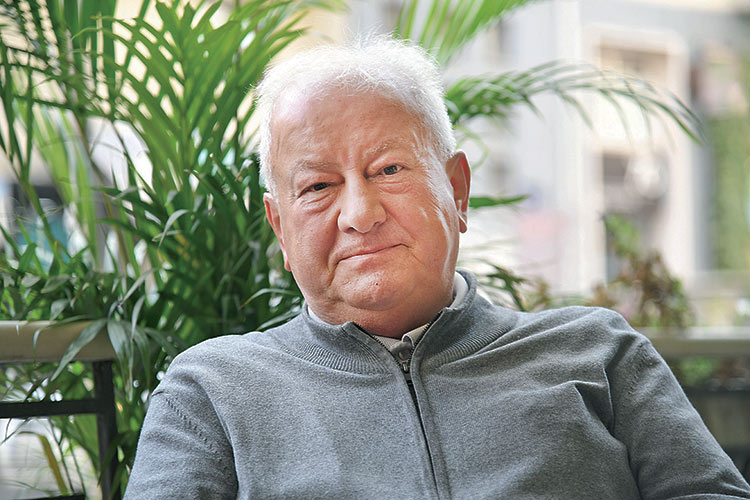

From apparently simple questions, like the interest rate citizens should borrow at during this juncture when inflationary movements are uncertain, to the way the world is confronting the current crisis and changing, we discussed the major topics of this century with economist Miodrag Zec

We must start this conversation from the issue of the relationship between globalisation and fragmentation, from the destroying of the freedoms and principles that form the basis of international relations and the winners and losers of that process, because without that we can’t understand what’s actually happening to us – says economist Miodrag Zec at the start of this interview for CorD Magazine.

“When one observes the period of the end of the 20th century and the beginning of the 21st century, it is evident that the world is exposed to terribly large changes, both in a production sense and an integrative sense, but also in terms of politics and values. The collapse of the East, the fall of the Berlin Wall, the unification of Europe and the geostrategic shuffling of cards leading to the establishing of a new global order. What was until recently a bipolar world transformed into the domination of a single superpower, and that is the United States. The driving idea of that entire period is globalisation, with the aim of separating places of consumption and places of production.

The West relocated production to the East in the hope that it would thus ensure its eternal domination. That is the main idea of globalisation. And relations between countries began changing at the same time. The European Union became a new political entity; the East was totally on the defensive, with the Berlin Wall broken and Russia falling apart. Simultaneously, the transition to the new century saw the emergence of an entire array of technological changes, digitalisation and the rise of the software industry,” explains our interlocutor.

How did these changes reflect on us?

Now, in the 2020s, we are bearing witness to a great test of the sustainability of such changes. They can only be tested when there is some kind of political, economic or social upheaval. Just as we can only test a building when a tremor occurs.

We can talk about them being good, being this and that, and write reports, but we’ll see for ourselves which are good and which aren’t when a tremor hits. The three major upheavals that have occurred – the financial crisis that ran from 2008 to 2011, the migrant crisis and the pandemic – showed us that the globalised economic order of world political values did not provide satisfactory answers. We can explain why this happened, we can seek apologies, but I don’t think the system reacted in the way it was expected to, i.e., it reacted in such a way as to invalidate the entire series of its support pillars.

Let’s begin with this latest pandemic. The system based on the free movement of goods, people and capital has been broken. The conviction that the system is based on empathy and solidarity has been crushed. Meaning that the entire array of the fundamental values of a united Europe and world order have been destroyed. I think this is an incontrovertible fact.

The problem of the workforce in Serbia is demography, emigrations and relations on the European labour market. The system is such that we, as countries on the periphery of the EU, are like self-service shops where the excise goods that Europe needs are taken

If we take a look at the migrant crisis, it turned out that, as a superpower, the United States – unlike Rome, which expanded to urbanise the world and civilise it by organising production, irrigation and new varieties – has ruined everything it’s occupied, from Afghanistan to Syria, Iraq etc. This is simply one model of civilisation that has proven to be invalid. At the same time, if we compare the global power of ancient times, i.e., Rome, we see that Rome provided a new algorithm as it expanded. And when that was exhausted, Rome began to wither and eventually collapse, with the barbarians taking over. I think America, and with that I mean Pax Americana, is at the end of that model, because there’s simply nothing left…

Now, in that globalisation that formed the basis for the distribution of political and economic power, and which had its roots in America, it turned out that those who were seemingly destined to play a losing role – namely the Chinese and peripheral peoples – are now the main winners of globalisation. Meaning that America, led by the particular interest of generating profits for individual companies, relinquished knowledge to those countries. They have conquered knowledge and now possess knowhow. And that’s why today’s China is a superpower and why it has the fastest growth. The complete opposite of what they thought would happen ended up happening. That the will be eternally dependent on development, and now China dictates that development. So, instead of losing, China proves victorious and America becomes the loser. It has lost its production power and found itself unable to produce anything when the pandemic came. It can’t even produce masks. The whole of Europe is also shaking.

And what kind of new world is that leading us towards?

When global and social processes are configured, it is very difficult to foresee all the effects of what will be and how it will be. With the migrant crisis, with the financial crisis, with the pandemic crisis, we have rocked an entire series of pillars of society that were considered eternal givens. And now we are entering a reconfiguration programme. Instead of globalisation, fragmentation is on the scene. Instead of liberalism, we see protectionism. The flow of goods is being cut off, the principle of the freedom of movement of goods is being imperilled. As a consequence, this will have ramifications for capital flows, then for the domain of labour.

And, thus, now there is a huge question-mark over the driving idea of the European Union – a Europe without borders. It was enough for there to be one pandemic, one seemingly minor factor, for the border of Europe to be re-established, to show that Europe is not a unified whole. For everyone to vaccinate their own population, for everyone to snatch vaccines from everyone else, for everyone to set some conditions for everyone else. One major political idea has not stood the test of time.

Moreover, Europe is losing its position in both the international economic system and the international political system, as it is participating less and less in the creation of world GDP and is being included in political issues less and less. Europe doesn’t have a single fast-growing company; it has no Alibaba, Amazon, Facebook or Google. What will become of Europe is a major question. The impotence of Europe’s growth has become obvious.

Yet still, when we look at GDP growth around world and in Europe, it seems that things are quickly returning to better times. Unlike in 2008, when fiscal stabilisation was the holy grail for all countries, this crisis has been approached in a completely different with significant infusions of money into the economy and directly to citizens. How far can such a policy be pursued generally?

The system has collapsed and now everyone is turning to the state and saying that the state will provide. That is being spoken about all over the world, but especially in Serbia. So, what can the state give that it hasn’t previously taken? The answer to this question is, in essence, a question: “what is money” and what purpose does money serve? Money is a medium of exchange that serves to ensure that we don’t trade with the help of bartering, but money is completely meaningless if there are no goods. We now have a situation where many think that the issue can be solved by issuing money from nothing. This disrupts the entire model of issuing money.

This pandemic has disrupted the basic principle of the European Central Bank. The ECB was conceived in such a way that it cannot lend to budgets, cannot buy government bonds and cannot cover deficits. And now we are heading in the totally opposite direction. The United States, in particular, is wallowing in debt, federal government bonds are being bought, the federal government is sharing that out, and when a growing amount of money encounters goods, inflation will normally occur.

Despite the mass printing of money, we haven’t seen inflation for a long time. If a Serbian citizen asked you today whether to take out a loan with a fixed or variable interest rate, what would you advise?

Inflation is everywhere, from the U.S. and elsewhere, but also in Europe, of four to five per cent. These rates are not dramatically high, i.e., they are proportional to the mass of money in circulation, and there can be various reasons for that. One is the fear of the future, so people hold back from buying, saving their spare money for rainy days and thus reducing inflationary pressure. At the same time, inflation exists in strategic goods, in gas, oil and real estate. The excessive issuance of money also hits another basic principle – the so-called property portfolio of the population.

GDP growth in our country comes through construction, through roads, through buildings. It does not come through the export industry. Hence, when the system grinds to a halt, you will have houses but nobody to buy them

When this is disrupted, the middle class becomes the victim. The middle class has monetary savings and is not engaged in business. You can’t expect me, as a university professor, to have a bakery, or some general to have a raft venue on the River Sava, to have a business. Quite simply, if you are in the middle class, you should have cash, you should have savings or shares in state-owned global companies. Here you can’t have shares in Telekom, rather our public policymakers direct you towards entrepreneurship. Everything boils down to petty business or mediating in state affairs. So, you organise an agency that gets a job, then you cancel the enterprise. That monetary policy has a whole range of consequences, independent of the consequences of this inflation. It defies logic.

On the other hand, if money is issued out of nothing, wealth cannot be acquired. Wealth can be acquired by producing something. In short, it disrupts the basic metabolism of society, its balance. The discount rate of the central bank is a basic thing that must be in balance. That is the primary interest rate, which is followed by the interest rate of commercial banks and then the profit rate. These three amounts define whether the system is normal. The interest rate on savings now stands at zero or is negative, profit rates are on the rise, while the discount rate is at zero. This means that you’re sending me the wrong signals, instead of curing diseases. When you have money in your bank account, your income is zero. When you borrow from a bank, the approved overdraft is 29%, while the unapproved overdraft is 39%. These are pathological differences. So, what will happen to citizens? If they try to borrow at a fixed interest rate – they can’t. There is interest that is variable, and that which is still variable is LIBOR. And LIBOR now stands at zero, while it could be 4% or more etc. As such, I would advise them to borrow at a fixed interest rate now, because that will never be available again, but it is unlikely that anyone will offer them that option today.

Part of the money from borrowing in Serbia is spent on the building of infrastructure, and it will soon also be spent on energy efficiency projects. How well-directed is this borrowing, considering that it is officially interpreted as propelling our GDP forward with great force?

When you finance something out of debt, a question arises as to how some have a surplus to lend and some do not. From whom do we borrow? From those who are able to create money by themselves, in dollars and euros. They have the right to lend the world’s money, while we do not. If you borrow money and make something, as we are doing, we will be confronted by the following question: can something that we’ve made repay the loans we took? That is the basic question. The current government has, through the machinery of propaganda, created a cult of GDP growth.

However, this is a more complex matter than it seems. Firstly, it is difficult to manage. Growth isn’t the only problem here; the structure of GDP is also a problem. The problem is what is growing? For example, if you want to strengthen yourself as a person, you eat more, invest more. Will you end up gaining a bigger belly or muscles? According to the same analogy, GDP grows when you build a house, but what will happen if you can’t rent out that house? You would be better off not building it.

GDP growth in our country comes through construction, through roads, through buildings. It does not come through the export industry. Hence, when the system grinds to a halt, you will have houses but nobody to buy them. Serbia and parts of Russia have the worst ratio between price per square metre and rent. If you are building apartments, you must have a balance between the price per square metre and rental rates, so you can repay the debt in seven or ten years. And that’s not the case here.

The people are fleeing from cash, avoiding money, fearing that money will lose its value completely. They’re being told as much by the media, by politicians, while the people go from one extreme to another, and to one bad portfolio. What will happen? How much were apartments worth in Detroit when General Motors fell? $100, $200? The economy is much more complex. It is a trivial science, but in essence is much more complex – like metabolism, like the way all life is complex. By treating cholesterol, you reduce it to zero – those are interest rates – and then you die. That’s because you also have to have cholesterol. If we don’t have any blood sugar, we die. If we have too much blood sugar, we also die. The issue is maintaining an equilibrium, and the system is much more complex than it seems to policymakers, to politicians who like easily promised speed. Do they know what’s best? If no one uses the roads, and the loans arrive, the big question is whether it makes sense to build them, whether we have the capacity. What’s the good in us having roads if we have nothing to transport on them? What are we going to drive at 300 kph and whose goods? Maybe Chinese goods to Thessaloniki and Budapest. And we have enough goods for a small van. We don’t have enough for trains. The question is whether we needed to be building high-speed railways for that?

We have to return to the basic principles of organising society that we have now side-lined. And those relate to whether the society respects individual freedoms: is it liberal; does it support individualism or collectivism; an open or closed economy, solidarity? What purpose does the state serve? It is terribly important for society to pose the question of its foundations

The environment, on the other hand, is terribly important. That’s not in dispute. But you take money for an environmental issue, which is good, while at the same time conducting an entire series of devastations that herald an environmental catastrophe. It’s important for the state to have a system that identifies a problem without error and solves it. Environmental issues are solved by passing a simple law on environmental protection. And that is for every city in Serbia and Europe to have to take its drinking water from a source downstream.

The majority of economists praised the major packages of measures aimed at helping the economy and citizens during the previous period, even at the cost of them being non-selective. Do you see a logical continuation of these measures in the latest promises of new benefits, or are we simply in a classic pre-election period where the government is using levers (economic) to buy votes?

Our state, which boasts of having given to everyone, should instead correct something that no one has so far corrected. No country in Europe has stolen pensions from one section of pensioners. And this doesn’t just represent a violation of rights, but rather a message to the middle class that they have no place here. It is normal that people will not pay into their pension fund now, because the whole system is based on the assumption that we will hijack something from our common coffers.

According to official statistics, earnings are increasingly improving in Serbia. Is it true that Serbia has ceased to be a country of cheap labour? What has happened to our labour market?

Serbia has ceased to be a country of cheap labour for some workers who’ve relocated abroad. There has been no increase in the salaries of doctors, educators and employees in standard occupations in Serbia. The salaries of welders increased, because they all went to Germany. And here at home we have yet to confront the problem of more people leaving the system than entering it, and that problem will become insoluble.

At the same time, we must ask ourselves whether this society encourages creativity and innovation, a regular system of acquisition or not? Does it offer options and does it offer stability? Successful societies provide everyone with the option of maximising their natural abilities and securing what they earn, but that isn’t the case here.

| CHANGES With the migrant crisis, the financial crisis and the pandemic crisis, we have rocked an entire series of pillars of society that were considered eternal givens and entered a process of general fragmentation | AMBIGUITY Borrowing through green bonds in order to solve environmental issues is good in principle, but it’s questionable whether we’re simultaneously witnessing numerous examples of taking risks with environmental disasters | DEVELOPMENT Successful societies are those that provide everyone with the option of maximising their natural abilities and securing what they earn, but that isn’t the case here |

|---|

Main photo: Vladislav Mitić