The Tokyo Metropolitan Government estimates that over the 18 year period between the announcement of Tokyo 2020 in 2013 and 2030 – 10 years after the actual games – Japan would see an economic impact of ¥32.3trn (€248 bln) for hosting the event, with the number of people in employment to rise by 1.94 million nationwide

Of the ¥32.3trn, the “direct effect” generated by direct investment and expenditure to host the games (such as maintenance costs for venues, operating expenses including security and transportation, and corporate marketing expenses) is estimated to be around ¥5.2bn yen.

The “legacy effect” is projected to be ¥27.1trn (€208bln) – far larger than the direct one – and this includes the impact on transport infrastructure development, the creation of barrier-free access, an increase in tourists visiting Japan, the use of competition venues post-event, and the expansion of sports participation. In this sense, it is more important for the Japanese economy to maximise the legacy effect.

Based on analysis of figures from previous games’ hosts, investment in construction related to the games will increase significantly in 2018, and that infrastructure and services will continue to be improved in the lead up to 2020. In addition to the games’ facilities, there is expected to be an increase in investment for new developments and renovation of hotels and commercial facilities, as well as maintenance and service improvements for airports, railways and public transport. In addition, demand for human resources (such as construction workers, salespeople, security and interpreters) will continue to increase, and thus lead to a growth in personnel related services. Also, as overseas visitors increase, there is expected to be a positive impact on the tourism and restaurant industry, as well as businesses related to fishing and agriculture.

Related: Tokyo 2020 Olympic Games Connecting Millions Of Visitors To The Future

We can also expect to see progress in technology-related initiatives, such as automatic driving and services using artificial intelligence (AI) and the internet of things (IoT).

Undoubtedly, games offer many opportunities for investors. Among infrastructure-related companies, the focus is on Nomura, which is involved in the design, construction and management of commercial and exhibition facilities. Totesusu Kogyo, a construction company with particular strengths in railway construction, is also to be noted. As for service-related companies, Star Mica, a leading company in pre-owned condominiums, is worth a mention for its focus on renovating flats and switching them to temporary lodgings to provide alternative accommodation to hotels. Gurunavi, which provides web-based recommendations of restaurants, has also caught our eye. In the human resources sector, the tightening labour market and the growing need for workers will benefit staffing agencies such as Hito-Communications. While in the restaurant sector, our interest is in Hiramatsu, which established itself with luxury French cuisine in Japan and will now be developing its brand through local Japanese cuisine.

Undoubtedly, games offer many opportunities for investors. Among infrastructure-related companies, the focus is on Nomura, which is involved in the design, construction and management of commercial and exhibition facilities. Totesusu Kogyo, a construction company with particular strengths in railway construction, is also to be noted. As for service-related companies, Star Mica, a leading company in pre-owned condominiums, is worth a mention for its focus on renovating flats and switching them to temporary lodgings to provide alternative accommodation to hotels. Gurunavi, which provides web-based recommendations of restaurants, has also caught our eye. In the human resources sector, the tightening labour market and the growing need for workers will benefit staffing agencies such as Hito-Communications. While in the restaurant sector, our interest is in Hiramatsu, which established itself with luxury French cuisine in Japan and will now be developing its brand through local Japanese cuisine.

The construction bill for all Olympic facilities is expected to be a whopping 635 billion yen, but the private sector is expected to spend much more than that. Mizuho Research Institute sees the private sector’s Olympic-inspired investment topping 10 trillion yen.

The estimates include urban renewal projects in Tokyo. The office and residential buildings are expected to cost 400 billion yen. Transportation links and other infrastructure is seen at 3.7 trillion yen.

East Japan Railway is also involved in Olympic-triggered construction. It plans to re-open a train station between Tamachi and Shinagawa stations in 2020. And Shinagawa Station is to be upgraded to accommodate maglev trains that will run along the Linear Chuo Shinkansen Line, which will start carrying passengers between Tokyo and Nagoya, central Japan, in 2027.

JR East, as it is better known, is also renovating seven other stations in Tokyo, including Harajuku — which will be the closest JR station to the main stadium.

Around 60,000 hotel rooms will be added across the country at a total cost of nearly 1 trillion yen, according to a Nikkei estimate. Mori Trust, a Tokyo-based property developer, plans to open two Edition hotels, a superluxury Marriott brand, in central Tokyo in 2020.

As for the Olympic technology showcase, Japan plans to start 8K broadcasts in 2018 fully. Also, 5G, or fifth-generation cellular service, is expected to be ready for the Olympics. And Nissan Motor intends to have autonomous cars driving on public roads by that summer.

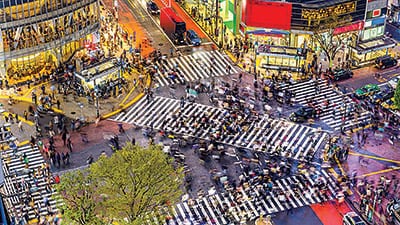

From a tourism perspective, in 2016 the central Japanese government doubled its target for the number of foreign visitors to Japan to 40 million visitors per year in 2020, and 60 million visitors per year in 2030. Tourism is one of the main pillars of prime minister Abe’s growth strategy, and it is seen as a trump card for regional revitalisation in Japan.

The government has accelerated the relaxation of its tourist visa conditions and has supported the repair of and the introduction of multilingual signage to over 200 cultural assets nationwide. This demonstrates a switch from placing importance on simply conservation to actively promoting tourism, as well as other areas such as attracting large international conferences and cultivating workforce in the industry. In addition, in 2019, a year before Tokyo 2020, Japan will become the first host of the Rugby World Cup in Asia, and will also host the G20 summit. These measures and events will increase the number of foreign visitors who repeat their visit even after Tokyo 2020, and therefore, the sector is a hot spot for investment opportunities in the country.

All of this still need to be considered in light of any moves by the Bank of Japan (BoJ). Last month (July 2017), the Japanese central bank decided to keep monetary policy unchanged, upwardly revising growth prospects, cutting the inflation outlook, and postponing the achievement timing of the 2% inflation target from around 2018 to around 2019.

This was a clear signal sent by the BoJ to the market that policy changes will not be made for the time being. Although it has been three years since the ultra-monetary easing policy was implemented to achieve 2% inflation in two years, the path to achieving this target is distant and it will not be easy to reach the postponed inflation target by 2019. Meanwhile, central banks in other major countries are ending monetary easing programmes. This means that there is now a clear difference in the stance of the BoJ and central banks of other major countries. Therefore, in the foreign exchange market, we expect the depreciation of the yen to continue up to 2020 due to the difference in the direction of monetary policy. Our belief is that this will continue to work positively for Japanese stocks in the future. And it will also be a welcome bonus for visitors who will make the long journey to Japan to enjoy Tokyo 2020 and the Rugby World Cup.

Published in ‘Japan 2018’ edition

The author is a lead strategist at SuMi TRUST