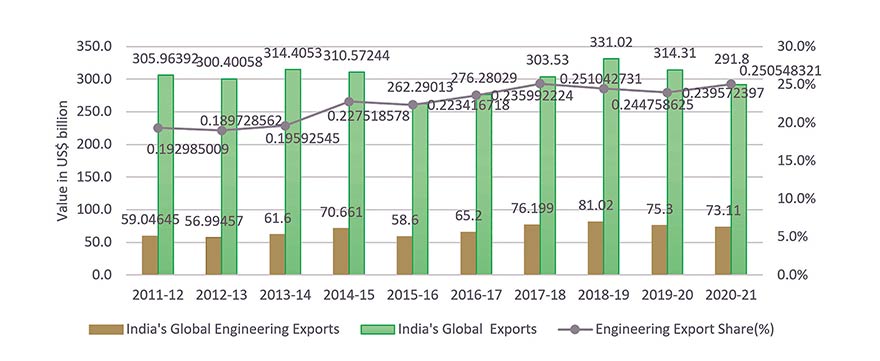

Engineering exports continue to remain as a champion sector for India accounting for more than a quarter of India’s total merchandise exports and around 3 percent of GDP. Between 2011-12 and 2020- 21, India’s engineering exports grew at a CAGR of 2.41 percent. The sector has remained India’s largest foreign exchange earner with its share in India’s total exports growing from 19 percent to more than 25 percent in the last ten years. The below figure indicates India’s total engineering exports in the last 10 years vis-à-vis India’s total merchandise exports and engineering’s share in merchandise exports.

The fiscal of 2020-21 witnessed significant de-growth in all economic factors including trade around the globe due to the COVID 19 pandemic. Mirroring the global trends both India’s merchandise and engineering exports in 2020-21 declined. The novel COVID-19 pandemic has added to the global health and economic crises. The lockdowns and shutting up of economic activities have heavily impacted the supply chains and global value chains. In cumulative terms, engineering exports for 2020-21 recorded a decline to the extent of 2.95 percent from US$ 75344.41 million in April-March 2019-20 to US$ 73119.60 million in April-March 2020-21.

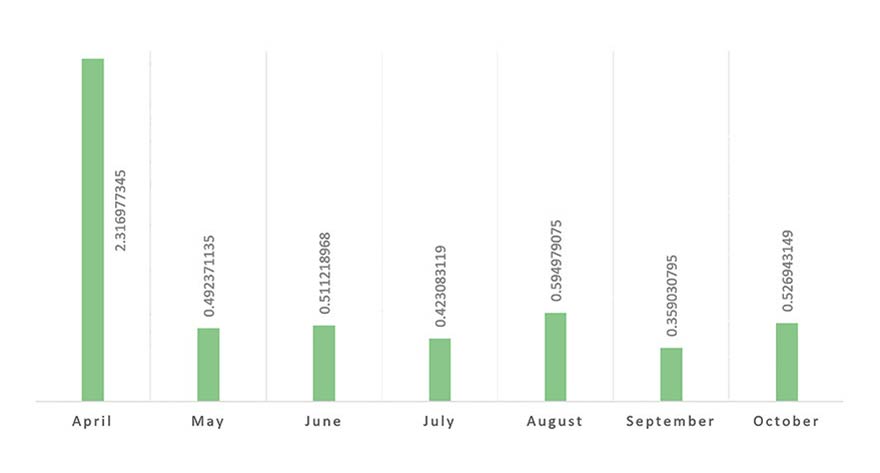

In 2021-22, however, engineering exports exhibited outstanding growth. Since April 2021, engineering exports have been experiencing positive growth as is indicated in the figure below. While the exceptional rise in April was due to the low base effect, exports continued the northbound journey in the following months as is indicated in the figure below.

Europe continued to remain one of the preferred destinations for India’s engineering exports

As per latest estimates India’s engineering exports during April-October 2021-22 stood at USD 60.98 billion, registering 59.14 percent growth over the shipments of April-October 2020-21 at USD 38.32 billion. Engineering exports in October 2021, also surpassed pre-pandemic levels of October 2019 continuing the trend of the past few months. Share of engineering in total merchandise export was 26.43 percent during April-September 2021-22 compared to same period last year. In cumulative terms, 31 out of 33 panels exhibited a positive year-on-year growth.

Maximum y-o-y growth witnessed in Iron and Steel and products, Non-ferrous Metals and products, Automobiles and parts, Industrial Machinery and parts during April-September 2021-22 vis-à-vis same period last fiscal. Region wise, during the period April-September 2021-22, EU and North America remained India’s topmost destinations for engineering exports with a share of 22% and 17% respectively, in India’s total engineering exports, and, ASEAN and North East Asia ranked third and fourth with a share of 12.4 % and 12 % respectively of the total engineering exports.

With major supply chain disruptions during the COVID pandemic, new opportunities have risen between India and Europe including countries like Serbia for enhanced commercial and trade linkages

Europe continued to remain one of the preferred destinations for India’s engineering exports. While Indian engineering exports suffered a setback in Europe especially the European Union in 2019-20 due to their restrictive protectionist stance, the region emerged as the numero uno destination in the current year for Indian engineering exports. Between 2018-19 and 2020-21, India’s engineering exports to Europe fell down by 9.4 percent, however, in the recent year, in April-October 2021-22, India’s engineering exports to Europe grew by 113 percent compared to the same period last year.

This is a very positive trend. Interestingly contrary to the European trend, India’s engineering export to Serbia, although small increased by 3.9 percent between 2018-19 and 2020- 21, whereas India’s exports to Serbia in April-October 2021-22 increased by 68.5 percent to reach USD 0.48 million from USD 0.28 million in April-October 2020- 21. Some of the panels where India and Serbia has potential for bilateral trade include electrical machinery, industrial machinery for dairy, agriculture, etc., auto components, iron and steel and products, aluminium and products, air-condition and refrigeration machineries and medical and scientific instruments.

With major supply chain disruptions during the COVID pandemic, new opportunities have risen between India and Europe including countries like Serbia for enhanced commercial and trade linkages. In recent times, Indian stakeholders have communicated with their European counterparts for greater trade associations between the two regions. The industry contemplates that in the coming years, the two regions will be able to increase their bilateral commercial associations to newer heights.

Source: DGCI&S