The world’s precious metals include iridium, ruthenium, rhodium, palladium, osmium, platinum, silver and gold. Among these eight precious metals, platinum is considered as being the most abundant and gold is the most widely available and acceptable, while over recent years we’ve seen a rapid rise in the popularity of osmium, the rarest precious metal

Investment gold and investment osmium are being increasingly discussed in today’s world, as they enable capital to be preserved in the right way, because – as history has shown – all currencies lose their value at some point. Over the past two years, individual governments have been considering adding osmium to their state reserves, because this precious metal is a long-term material investment.

Precious metals, particularly gold, silver, platinum and palladium, have had a high economic value since time immemorial, particularly during times of economic crisis. They are valuable precisely because they are not abundant in nature and are commonly used to produce high-end jewellery, in industrial processes and as investment vehicles. Precious metals offer unique protection against inflation. They have an intrinsic value, don’t carry credit risk and their value cannot be artificially “pumped”, i.e., they cannot be multiplied, printed or easily found in nature. They are also valuable because they provide a high degree of security against financial shocks and political upheavals.

THE WORLD POSSESSES 190,000 TONS OF GOLD

Gold was first discovered by ancient Egyptians in Nubia around 2450 BC, while the etymology of its name is derived either from the Indo-European word “ghel” of the Anglo-Saxon word “geolo”, both of which mean yellow. The Kingdom of Lydia, which was located on the territory of Anatolia that now forms part of western Turkey, was the first nation to use gold and its alloys for trade, only to later be used as a currency, a store of value and to make valuable jewellery.

Estimates suggest that the amount of gold extracted worldwide totals almost 163,000 tons. If all that gold were melted down and poured into one block, it would form a 20x20x20-metre cube. More than half of this amount has been processed to create jewellery or used in industry. The rest is retained, in the form of coins and ingots, for investment purposes by institutional investors, central banks and private individuals. Investment gold is being increasingly discussed in today’s world, as it enables capital to be preserved in the right way, because – as history has shown – all currencies lose their value at some point. Investment gold is currently among the best ways to preserve capital on the market, because investing in gold offers, among other things, the possibility of complete anonymity during transactions.

Investing in gold successfully protects capital against shocks on the world financial scene, while it can also yield additional profit in the case of global economic crises. The recent financial crisis has caused the price of gold to experience a constant upward trajectory.

The price of gold has risen constantly throughout history. Thus, for example, in 1977 an ounce cost approximately 130/140 dollars, while by 2017 and 2018, 40 years later, that price had risen to around 1,300 dollars and today hovers at around 1,600 dollars. This trend has also continued throughout the last decade. The price of gold is currently up as much as 45% and there is no hint of this rise stopping, particularly considering that the value of money continues to fall.

POPULARITY OF THE “ELEMENT OF THE SUN” ON THE RISE

Due to shortages of investment gold, the market crisis and increasing difficulties linked to supplies, trade in osmium has emerged as a new option with the same function. This precious metal has been present on the world market for less than eight years, with sales in Europe having leapt by 500% during that time. Osmium is the rarest of precious metals when it comes to quantity and the most precious in terms of value. This is a precious metal of exceptional purity that has the highest durability among all such metals. The production of osmium is also dependent on the production of platinum, with 10,000 tons of platinum containing only around 30 grams of osmium. In terms of quantities, osmium is 1,500 times rarer than gold, 1,000 times rarer than diamonds and 2,500 times rarer than silver.

Osmium is impervious to counterfeiting. It is extremely stable; prices are constantly on the rise and the rate of growth is higher than among other precious metals

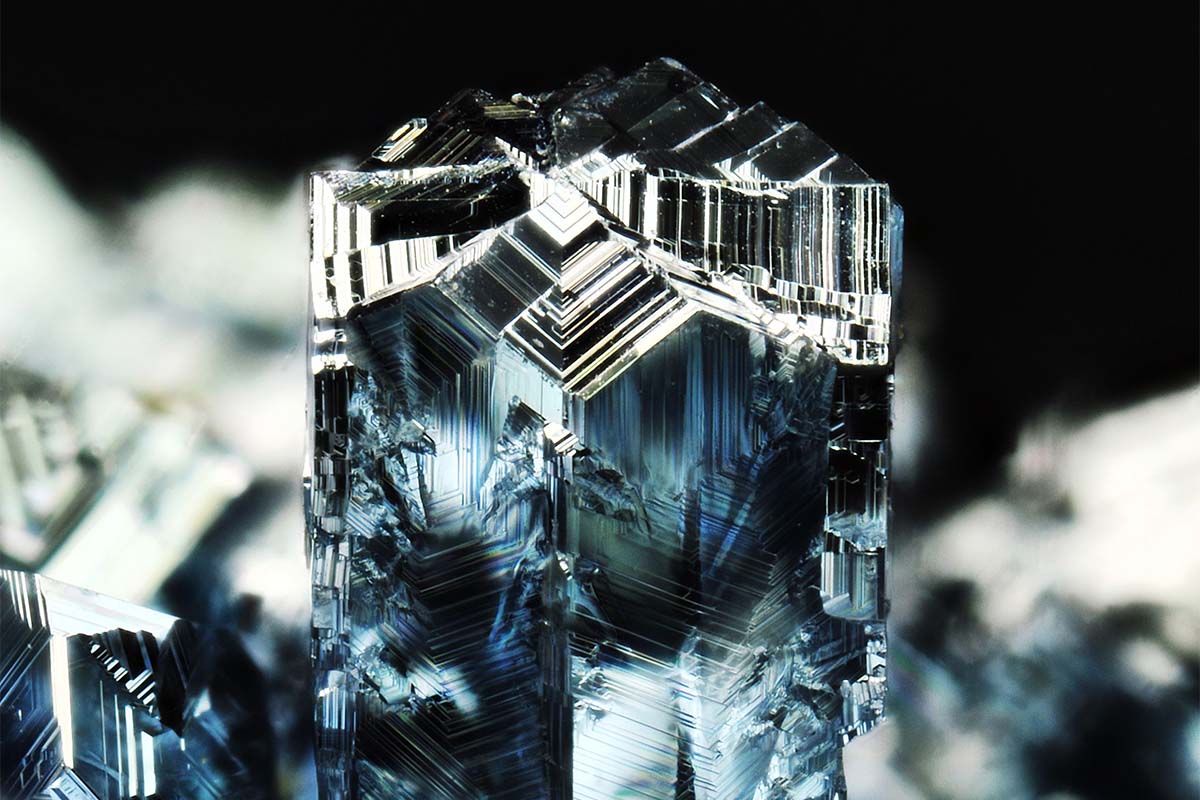

Osmium is available to investors in its crystallised form. Crystallisation implies high laboratory safety measures due to its specialised chemistry and requires great time and energy. It is known as the “Element of the Sun” due to its exceptional beauty. Osmium is used to produce extremely exclusive jewellery and as an investment metal for long-term capital investments.

Osmium is characterised by its unique blue-silver and blue-white lustre, which becomes particularly prominent when it is illuminated by sunlight. It also glistens exceptionally when illuminated by the light emitted by LED bulbs.

INVESTING IN OSMIUM INCREASINGLY PAYING OFF

As an irreplaceable and incredibly rare metal, osmium will prove even more valuable during future times of crisis, given that ever more investors are discovering it as a new investment opportunity. Osmium has only been present on the precious metals market since 2014. Due to its crystalline lustre and other unique qualities, it has quickly taken a leadership position on this market segment and found itself in high demand in 2020, primarily as a way of protecting capital against crisis, inflation and property price fluctuations. Thanks to it not being correlated with stocks, the euro and interest rates, osmium serves as an anchor of stability, particularly in diversified portfolios, reducing the overall risk to which they are exposed. Osmium also has certain market advantages and unique selling points. As a limited resource that it is impossible to falsify, it is characterised by its extraordinary beauty and elegance. It can also be bought using cryptocurrencies and can be exchanged for other precious metals.

It makes more sense than ever to buy osmium today. Even individual governments are considering the inclusion of osmium in their state reserves, as this precious metal is a long-term material investment that is easily transported and can be stored in safes for many years without the need for any special conditions.

Testifying to just how much it pays off to invest in osmium is the fact that, over the course of nine years, the price of gold has increased by 96%, at an average of 12% annually, while during the same period the price of osmium increased threefold, giving it a value almost 300% higher. One gram of osmium costs around 1,800 euros, i.e., 30 times more than the same amount of gold, while just five years ago, in 2017, the price was around 800 euros, meaning that its value is today more than 100 per cent higher. In comparison, a gram of gold on the world market is priced at around 55 euros.

This has all resulted in ever more people realising that money is losing value and that they should convert their savings to precious metals, as opposed to paper currencies. It currently pays off the most to save in osmium, the value of which is constantly on the rise, unlike the value of gold or cryptocurrencies.